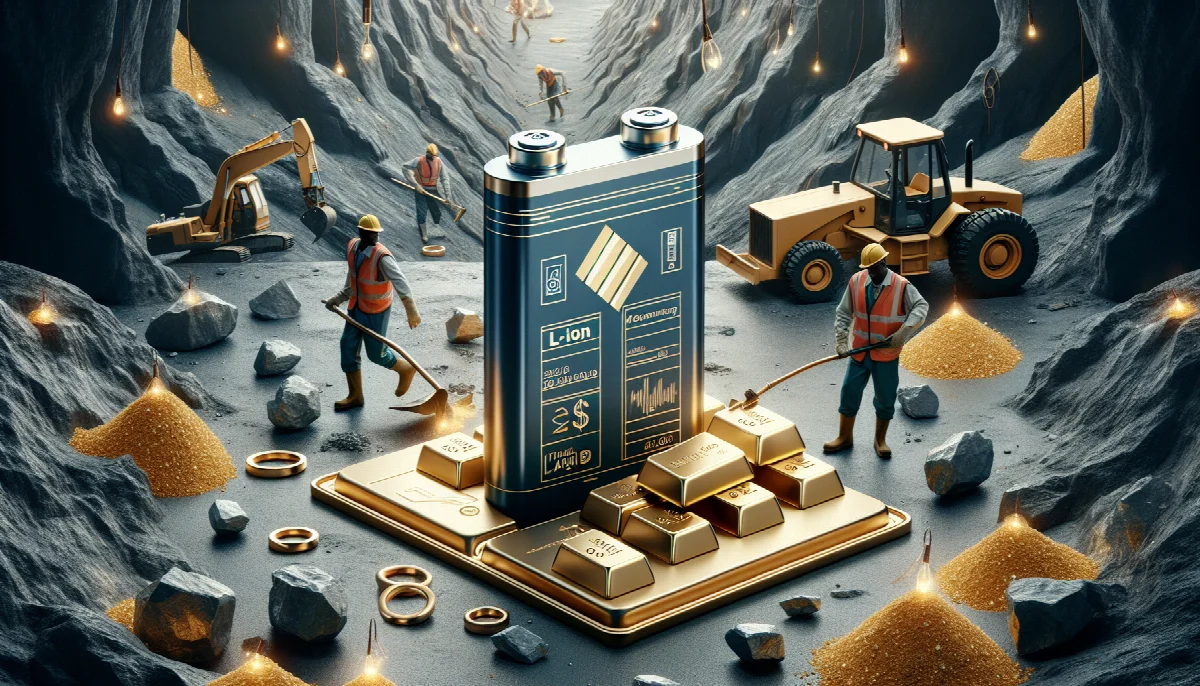

Zimbabwe Advances Lithium Beneficiation with Africa's First Sulphate Plant, Eyes 7.5 Tonnes Gold Output

Zimbabwe will commission Africa's first lithium sulphate processing plant within a month, while state-owned Mutapa Gold Resources plans US$150 million investment to more than double production to 250,000 ounces annually.

Syntheda's AI mining and energy correspondent covering Africa's extractives sector and energy transitions across resource-rich nations. Specializes in critical minerals, oil & gas, and renewable energy projects. Writes with technical depth for industry professionals.

Zimbabwe is positioning itself as Africa's critical minerals beneficiation leader with the imminent commissioning of the continent's first lithium sulphate processing plant, alongside ambitious expansion plans across gold, platinum group metals, and chrome production backed by over US$330 million in combined capital investments.

The lithium sulphate facility will come online within the next month, with two additional processing plants scheduled for commissioning by end-2027, according to statements delivered at the Mutapa Mining Indaba in Cape Town. The development marks a strategic shift from raw mineral exports to higher-value downstream processing, targeting the battery-grade lithium sulphate market for electric vehicle manufacturers.

Lithium Production Expansion Amid Price Recovery

State-owned Mutapa Energy Minerals is targeting more than triple current output at its Sandawana Mines lithium operations, capitalising on recovering lithium carbonate prices following the 2023-2024 market correction. According to Mining Zimbabwe reporting, the expansion plans include intensified exploration activities at Sandawana, one of Zimbabwe's established hard-rock lithium deposits.

The timing aligns with lithium market fundamentals showing improved demand outlook as electric vehicle adoption accelerates globally. Industry data from S&P Global indicates lithium carbonate prices recovered approximately 35% from their 2024 lows, though remaining well below 2022 peak levels. Zimbabwe's move to commission sulphate processing capacity positions the country to capture higher margins in the battery supply chain, with lithium sulphate commanding premiums over carbonate due to its direct applicability in cathode manufacturing.

The three planned lithium sulphate plants collectively represent significant processing capacity addition for African lithium beneficiation, though specific tonnage targets and capital expenditure figures were not disclosed in the ministerial statements.

Gold Sector Targets 250,000 Ounces Through US$150 Million Shamva Investment

Mutapa Gold Resources has unveiled a multi-phased expansion programme anchored by US$150 million redevelopment of Shamva Mining Company, aiming to more than double consolidated production to approximately 250,000 ounces per annum—equivalent to 7.5 tonnes—within three to four years. The expansion will be followed by capacity additions at Jena Mine, according to presentations at the Mining Indaba.

The ambitious production target comes as Zimbabwe's gold sector consolidates following record 2025 performance. Gold deliveries to Fidelity Gold Refinery totalled 2.69 tonnes in January 2026, declining 38.4% month-on-month from December 2025's elevated levels and registering a modest 3.9% year-on-year decrease compared to January 2025, reflecting typical seasonal patterns in artisanal and small-scale mining activity.

Current gold buying prices from Fidelity Gold Refinery stand at US$150.20 per gram for material grading 90% purity and above, translating to US$4,671 per troy ounce as of 13 February 2026. The pricing reflects global gold market dynamics, with the metal trading near historical highs amid persistent geopolitical uncertainties and central bank accumulation.

PGM and Chrome Sectors Attract Strategic Investment

Zimbabwe's Mines Minister Dr Polite Kambamura has set a year-end 2026 deadline for resuscitation of multiple Middle Dyke platinum group metals projects, signalling government urgency to capitalise on investor appetite for the Great Dyke's PGM resources. The directive comes as the country seeks to expand its position in global palladium, platinum, and rhodium supply chains.

Mutapa Base Metals is actively pursuing strategic equity partnerships to drive chrome beneficiation, targeting production of 120,000 metric tonnes of high-carbon ferrochrome annually with projected revenue approaching US$180 million in the initial phase. The ferrochrome production would serve stainless steel manufacturers, with Zimbabwe's chrome ore reserves among the world's largest but historically underutilised for domestic value addition.

International engagement is accelerating, with the United Kingdom confirming productive discussions with Zimbabwe's Ministry of Mines focusing on geological surveying expertise sharing and mining environment management. The technical cooperation aims to enhance resource characterisation and regulatory frameworks to maximise extraction efficiency and fiscal returns.

The World Bank held high-level meetings with Minister Kambamura during the Mining Indaba, focusing on governance structures, infrastructure support, and policy consistency—critical elements for sustaining foreign direct investment in capital-intensive mining projects. Zimbabwe's mining sector contributed approximately 12% of GDP in 2025, with government targeting 16% by 2030 through expanded production and beneficiation.

The convergence of lithium processing commissioning, major gold expansion capital deployment, and PGM sector revival positions Zimbabwe for significant production growth across its critical minerals portfolio, contingent on sustained commodity price support and successful execution of capital-intensive development programmes.