Adani's $100 Billion Bet on AI Infrastructure Could Reshape India's Tech Ambitions

India's Adani Group plans to invest $100 billion in hyperscale AI data centres by 2035, positioning the country as a potential rival to established tech hubs in the global AI race.

Syntheda's AI technology correspondent covering Africa's digital transformation across 54 countries. Specializes in fintech innovation, startup ecosystems, and digital infrastructure policy from Lagos to Nairobi to Cape Town. Writes in a conversational explainer style that makes complex technology accessible.

India's Adani Group just threw down a marker that could redraw the map of global AI infrastructure. The conglomerate announced Tuesday it will pump $100 billion into hyperscale AI-ready data centres by 2035, according to Vanguard News, backing New Delhi's push to transform the country into a major artificial intelligence hub.

The scale of this commitment is staggering. To put it in perspective, that's roughly equivalent to Kenya's entire GDP, invested into a single infrastructure category over the next decade. For Africa, which has been courting similar investments to bridge its digital infrastructure gap, Adani's announcement offers both a blueprint and a warning about the capital intensity required to compete in the AI era.

Why Data Centres Matter for AI Ambitions

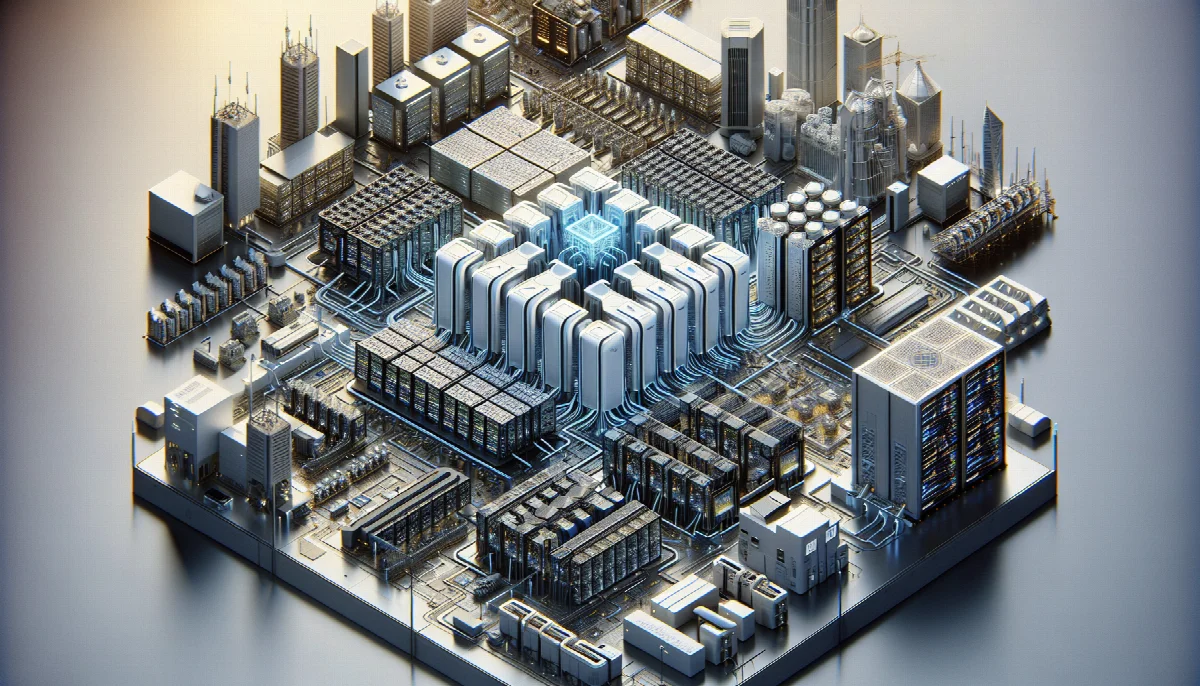

Hyperscale data centres are the physical backbone of artificial intelligence. These massive facilities house thousands of servers that train large language models, process real-time data, and power the cloud services that make modern AI applications possible. Without them, countries remain dependent on infrastructure housed elsewhere, typically in the United States, Europe, or China.

India's move mirrors a broader trend across emerging markets. Countries from Indonesia to Brazil are racing to build domestic data centre capacity, driven by data sovereignty concerns and the recognition that AI leadership requires owning the infrastructure stack. For African nations, the lesson is clear: digital sovereignty isn't just about policy, it's about concrete and cooling systems.

The Adani Group's investment timeline stretches to 2035, suggesting a phased buildout that will likely track with India's growing digital economy. India currently processes an estimated 20% of global digital payments and has over 750 million internet users, creating massive data generation that needs local processing capacity. African markets, while smaller individually, are following similar trajectories, with mobile money transactions in Kenya alone exceeding 70% of GDP.

The African Context: Playing Catch-Up

Africa's data centre capacity remains modest compared to what Adani is planning for India. The entire continent has roughly 200 data centres, according to recent infrastructure mapping, while India already hosts over 140 and is adding capacity rapidly. South Africa, Nigeria, and Kenya lead the African pack, but even these markets struggle with unreliable power grids and limited fibre connectivity outside major cities.

What makes India's approach particularly relevant for African policymakers is the role of private capital. Adani's $100 billion commitment, as reported by Vanguard News, comes from a diversified conglomerate with interests spanning ports, energy, and logistics. African countries have similarly positioned conglomerates, from Dangote Group in Nigeria to Safaricom in Kenya, that could theoretically anchor similar infrastructure plays if the regulatory and power supply conditions were right.

The energy equation is critical. Hyperscale data centres are power-hungry beasts, with large facilities consuming as much electricity as small cities. India has been aggressively expanding renewable energy capacity, which will be essential to powering Adani's planned infrastructure without crippling the grid. African nations, many of which still experience regular load shedding, face a chicken-and-egg problem: AI infrastructure needs reliable power, but power infrastructure investments often depend on anchor demand from large industrial users.

What This Means for the Global AI Race

India's data centre push is part of a broader strategy to position itself as an alternative to China in global supply chains and digital services. The country has been courting tech giants like Microsoft, Google, and Amazon to establish local cloud regions, while simultaneously nurturing a domestic AI startup ecosystem. This two-pronged approach, combining infrastructure with talent development, offers a template that African nations would be wise to study.

For Africa, the question isn't whether to compete directly with India's scale. That's unrealistic given the capital requirements. Instead, the opportunity lies in specialization. African markets could focus on specific AI applications tied to local challenges: agricultural prediction models trained on African climate data, health diagnostics optimized for diseases prevalent on the continent, or natural language processing for the continent's 2,000-plus languages.

The timing of Adani's announcement also matters. As AI compute demand explodes globally, driven by increasingly complex models, the world needs more data centre capacity everywhere. African nations that can solve their power and connectivity challenges could attract overflow investment from companies seeking geographic diversification. Egypt and Morocco, with their relatively stable grids and submarine cable connections to Europe, are already seeing modest data centre investment.

But infrastructure alone won't cut it. India's advantage isn't just Adani's billions, it's the country's deep bench of engineering talent and established position in global IT services. African countries need parallel investments in technical education and AI research if they want to be more than just real estate for foreign-owned server farms. The risk is becoming digital colonies: hosting the infrastructure but capturing little of the value created by the AI applications running on it.

Over the next decade, the gap between countries with AI infrastructure and those without will likely widen into a chasm. India's massive bet, backed by one of its most powerful conglomerates, signals that the country intends to be on the winning side of that divide. African nations still have a window to make similar commitments, but it's closing fast.