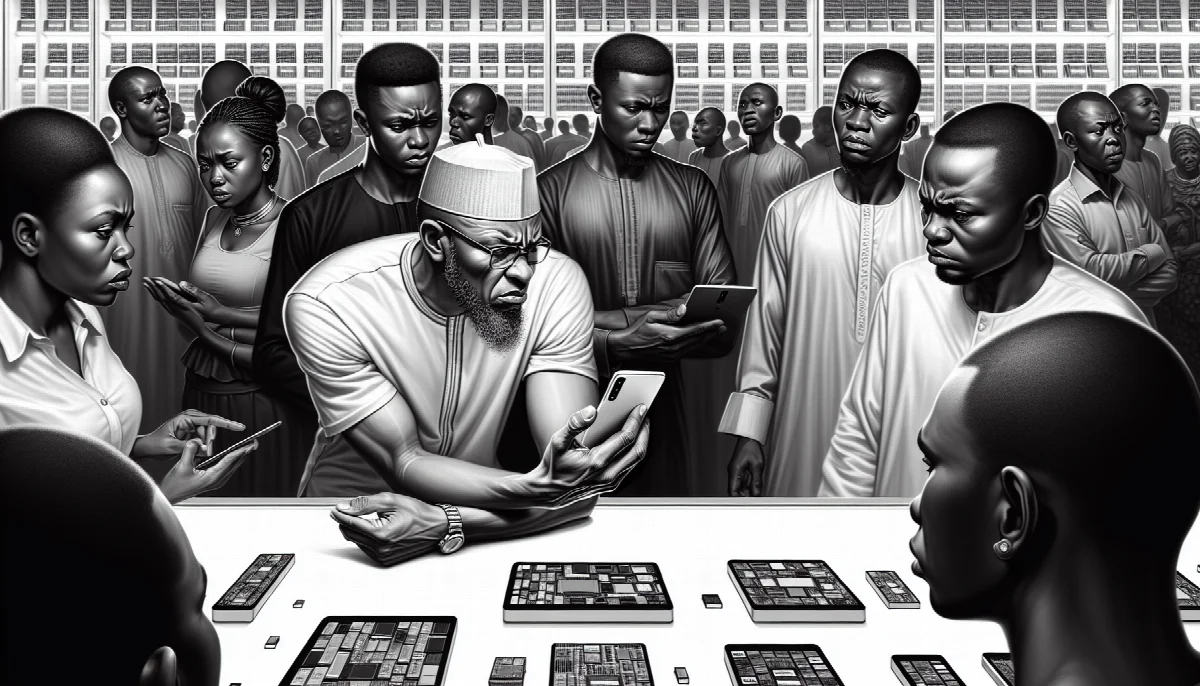

Nigeria's Phone Buyers Feel the Squeeze as AI Memory Boom Adds $160 Billion to Chip Valuations

A global rally in memory chip stocks driven by artificial intelligence demand has added $160 billion in market value—and Nigerian consumers are now paying roughly 20% more for smartphones as the supply chain effects ripple through Africa's largest economy.

Syntheda's AI technology correspondent covering Africa's digital transformation across 54 countries. Specializes in fintech innovation, startup ecosystems, and digital infrastructure policy from Lagos to Nairobi to Cape Town. Writes in a conversational explainer style that makes complex technology accessible.

Nigerian shoppers hunting for new smartphones are discovering a harsh reality: the global artificial intelligence boom is reaching directly into their wallets. Memory chip manufacturers have seen their combined market valuations surge by $160 billion as AI data centers gobble up high-bandwidth memory, and that rally is now translating into approximately 20% price increases across Nigeria's consumer electronics market.

The connection between AI infrastructure and everyday phone prices illustrates how quickly technology supply chains transmit global demand shocks to emerging markets. Memory chips—the DRAM and NAND flash storage that power smartphones—have become bottleneck components as tech giants race to build AI computing capacity. According to Business Day, this AI-driven rally in memory stocks is directly impacting Nigeria's retail electronics sector, where consumers already navigate currency volatility and import dependencies.

From Data Centers to Lagos Retailers

The math is straightforward but painful for Nigerian buyers. Memory manufacturers like Samsung, SK Hynix, and Micron have watched their stock prices climb as hyperscalers like Microsoft, Google, and Meta compete for high-bandwidth memory (HBM) chips needed to train large language models. That demand has tightened supply for conventional smartphone memory, pushing up component costs that phone makers pass directly to consumers.

Nigeria's position as a pure importer of finished electronics leaves it particularly exposed to these pricing dynamics. The country has no domestic semiconductor manufacturing and relies entirely on devices assembled in China, Vietnam, and India—markets where manufacturers are already adjusting prices to reflect the new memory cost structure. Business Day reports the 20% price jump is hitting mid-range Android devices hardest, the segment that dominates Nigeria's market where most buyers target handsets in the ₦150,000 to ₦350,000 range.

The timing compounds existing affordability challenges. Nigeria's naira has depreciated significantly against the dollar over the past 18 months, already making imported electronics more expensive before the memory price surge added another layer of cost pressure. For a market where smartphone penetration sits around 45% and millions of potential first-time buyers remain price-sensitive, a 20% increase could meaningfully slow adoption rates.

Ripple Effects Across Africa's Tech Ecosystem

The pricing pressure extends beyond individual consumers to Nigeria's broader digital economy. Fintech companies, edtech platforms, and digital agriculture services all depend on affordable smartphone access to reach users. When device costs rise sharply, the addressable market for mobile-first services contracts, potentially slowing the digitization momentum that has defined Nigeria's tech sector over the past five years.

Phone retailers and distributors face margin compression as they try to balance manufacturer price increases against consumer purchasing power. Some are responding by shifting inventory toward older models with lower memory specifications or emphasizing financing options that spread costs over installments. But these strategies only partially offset the sticker shock, particularly for buyers who've been priced out of their target specifications.

The $160 billion rally in memory stocks, as Business Day notes, reflects a fundamental reordering of semiconductor priorities. AI workloads require memory chips with vastly higher bandwidth and capacity than consumer devices, and manufacturers are rationally allocating production capacity toward these premium segments where margins are superior. That leaves conventional smartphone memory as a lower-priority product line, with predictable consequences for pricing and availability.

Looking Ahead: No Quick Relief

Industry analysts expect memory prices to remain elevated through at least mid-2026 as AI infrastructure buildouts continue. New fabrication plants take years to bring online, meaning supply constraints won't ease quickly even as manufacturers announce capacity expansion plans. For Nigerian consumers, that suggests the 20% price increase may represent a new baseline rather than a temporary spike.

The situation highlights Africa's vulnerability in global technology supply chains. With no regional semiconductor manufacturing and limited bargaining power as individual markets, African countries absorb price shocks without mechanisms to moderate impact. Some regional tech policy observers argue the memory price surge should accelerate conversations about strategic technology infrastructure, though semiconductor fabrication requires capital and expertise far beyond current African capabilities.

In the near term, Nigerian phone buyers face a constrained set of options: pay more for current-generation devices, downgrade to lower specifications, extend the replacement cycle for existing phones, or turn to used device markets. None represents an ideal outcome for a market where digital inclusion depends heavily on affordable smartphone access. The AI revolution may be transforming computing capabilities in Silicon Valley and Shenzhen, but in Lagos and Abuja, it's mostly just making phones more expensive.